Recently, I went to my usual barbershop. I was chatting with my barber as he gave me the usual cut. Then, the conversation flowed to the topic of cryptocurrencies.

He explained to me, as he tidied my sides, his insights on Bitcoin and why he was getting into some altcoins. I don't know if he notices but this gave me goosebumps. It had dawned on me that I was reliving an old cautionary parable of the business world.

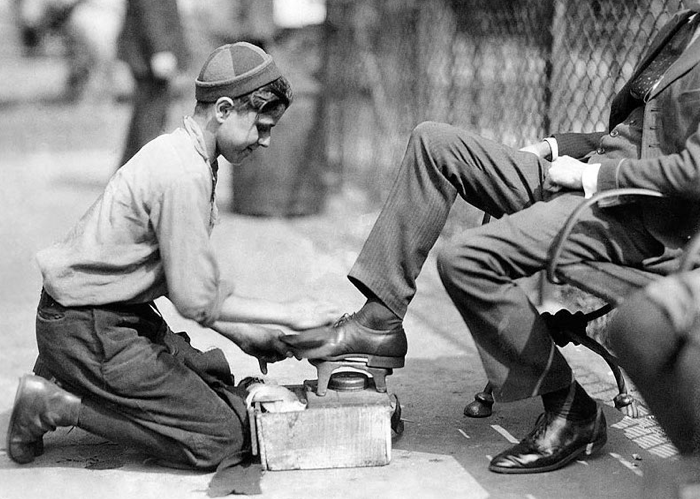

The Story of Joe Kennedy and the Shoeshine Boy

What I was eerily reminded of is a Wall Street urban legend involving a shoeshine boy and Joseph Kennedy Sr. Yes, of that Kennedy family. This Kennedy is the father of our 35th President; he's the patriarch of Camelot. As a young man in the early 20th Century, he began building his family fortune in the stock market and in commodities trading. He also went on to make a killing during and after the prohibition by securing distribution rights for Scotch and other British spirits. Clearly, he was a man of foresight.

As the story goes, one day in 1929, Joe Kennedy is getting his shoes shined. The boy began to give stock tips as he polished Kennedy's oxfords. In that moment, it struck Joe that he needed to leave the market. He reasoned, famously, if shoeshine boys have an opinion on stocks, the market is clearly, dangerously popular. Supposedly, he pulled out not long before the stock market crash, which led to what we know today as the Great Depression.

I mention the legend of Joe Kennedy and the shoeshine boy not to be a blanket dismissal of barbers. It's a great lesson--or at least a good rule of thumb--on recognizing monstrous levels of hype and instability. The reality is that people are jumping recklessly into promising markets for things they don't (or won't bother to) understand. They misjudge value and are often chasing short-term gains on a highly volatile market.

Dot Com Deja Vu

What my barber signals are that cryptocurrencies have become a speculative frenzy. We've seen this sort of hyped race to the bottom before with internet stocks in the 90s. At its height, companies with little more than a ".com" at the end of their name went immediately public and traded instantly for exorbitant prices. Hence, the nickname, "Dot Com Bubble." Alan Greenspan immortalized it as "irrational exuberance." There was a ton of bad investing with short-sighted goals. It spanned everyone--entrepreneurs, VCs, big banks, day traders.

As evidenced by the 90s, supposed business pros get short-sighted, too. But those like my barber or the prodigal shoeshine are indicative of hype seeping deep into the public consciousness. My barber, like most of the general public, is far downstream in the flow of information. Most likely, he only learned of cryptocurrency in the last few months and joined in the craziness very recently.

Meanwhile, people who keep up with technology or financial issues first started really catching wind of Bitcoin and blockchain in 2011. As Wired outlines in one of its earliest features on cryptocurrencies, Bitcoin had its first major peak and collapse in 2011 following a Forbes profile and a Gawker story on Silk Road, a major online black market at the time. Amusingly, the title of this story was "The Rise and Fall of Bitcoin."

The Other Side of the (Bit)Coin

While there was some misplaced hype, the potential of the internet and the digital was real. We've seen enormous changes and disruptions in the very fabric of the world economy in the past two decades. Much like then, if you cut through all the quick-money clutter, the potential in cryptocurrencies is very real. Imagine investing in Amazon in the 90s or Google in the early 2000s.

I decided to buy cryptocurrencies for three reasons. First, I sought to support the potential it had to realize free, open markets--which I deeply believe in. Second, the more I learned about the technology, I realized how much promise it had in bringing massive waves of change. Finally, I wanted to keep learning more and I knew the best way to do so would be to have some skin in it.

In other words, I'm not in it to make a quick buck. My investment is not in trading and flipping assets. It is in the future that is digital, transparent, unregulated, secure, and accountable.

If you're thinking about jumping into the cryptocurrency game, be my guest. Just remember Joe Kennedy and consider if you are more like me or my barber.